Best Investment platform in Nigeria

Investment platforms in Nigeria have become increasingly popular as they provide individuals with convenient and accessible avenues to invest their money. These platforms serve as intermediaries, connecting investors to various investment opportunities and offering a wide range of financial products and services.

Leveraging technology, these platforms simplify the investment process by allowing users to invest in different asset classes, including stocks, mutual funds, bonds, and real estate. With user-friendly interfaces and robust investment tools, they have revolutionized the way people invest in Nigeria. See Top 10 best African country to invest in real estate 2023

When you want to choose an investment platform, questions like “Which investments have the best returns in Nigeria? Which investment app pays daily in Nigeria? What is the best investment for monthly income in Nigeria? Runs through one’s mind.

Choosing a reliable investment platform is crucial for maximizing returns and reducing risks. Trustworthy investment platforms conduct due diligence on investments, providing security against fraud. They also offer convenience through user-friendly interfaces and mobile apps. Education and customer support are additional benefits, empowering investors to make informed decisions. Transparent platforms prioritize data security and provide clear information on fees and investment performance. By selecting the right platform, individuals can invest confidently and achieve their financial goals.

List of the 10 Best Investment Platforms in Nigeria 2023

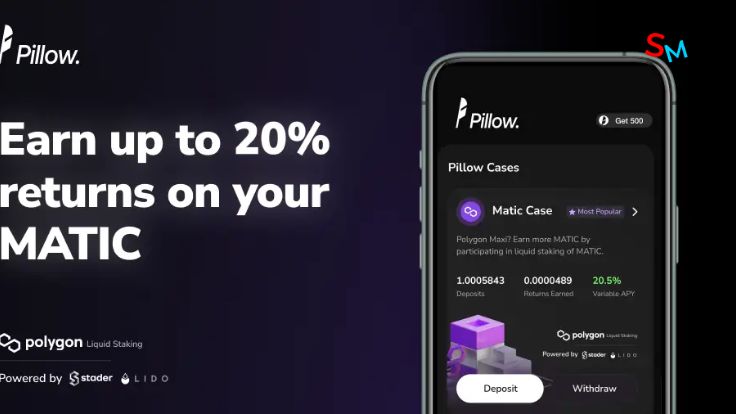

1. Pillow Fund

Pillow Fund is a legitimate mobile investment platform in Nigeria that provides users with easy access to a variety of investment options. It aims to simplify the investment process and help individuals grow their savings. Regulated by the Securities and Exchange Commission (SEC), Pillow Fund has gained a positive reputation and garnered trust among its growing user base.

To invest in Pillow Fund, simply download the app from the Google Play Store or Apple App Store and create an account. Link your bank account to the app, deposit funds into your Pillow Fund account, and choose the investment products that align with your financial goals and risk tolerance. The platform offers flexibility, allowing users to start with a relatively low minimum deposit, which varies depending on the investment option chosen.

Withdrawing money from Pillow Fund is a straightforward process. Initiate a withdrawal request through the app, and the platform will process it within a specified timeframe. The funds will be transferred directly to your linked bank account. Keep in mind that certain investments may have specific lock-in periods or withdrawal restrictions, so it’s important to review the terms and conditions beforehand.

The amount of money required to start a fund on Pillow Fund depends on your investment goals and the investment options you choose. The platform caters to investors with varying budgets, allowing you to start with as little as a few thousand Naira or invest larger sums. It’s crucial to determine an investment amount that aligns with your financial situation, goals, and risk tolerance.

Pillow Fund offers a user-friendly app interface and operates within the regulatory framework set by the SEC. It provides a legitimate and convenient platform for Nigerians to save and invest their money. Whether you’re a beginner or an experienced investor, Pillow Fund can be a viable option to grow your savings and achieve your financial objectives.

2. PiggyVest

PiggyVest is a reputable investment platform in Nigeria that offers a range of savings and investment options to users. The platform operates under the approval of the Central Bank of Nigeria (CBN) as a licensed microfinance bank and is insured by the Nigeria Deposit Insurance Corporation (NDIC), providing users with added confidence and security. With a focus on data security, PiggyVest ensures that users’ personal information and funds are protected using high-level banking security measures and 256-bit SSL security encryption.

One of the key features of PiggyVest is its flexibility in earning potential. Users can earn an interest rate of 8% per annum on funds held in their Flex account, subject to a minimum of four withdrawals per month. However, exceeding the four-withdrawal limit in a month results in the forfeiture of accrued interest on Flex savings.

When it comes to withdrawals, PiggyVest offers flexibility as well. Users can withdraw any amount from their Piggybank account, with a minimum withdrawal limit of N3000. There is no maximum withdrawal limit, but it’s important to note that fixed withdrawal dates may apply, allowing users to make one withdrawal per 24-hour period.

PiggyVest has a notable history as the first online “Savings & Investment” app in West Africa. Initially launched as “Piggybank.ng” in 2016, the platform solely focused on savings. However, it has since expanded its services to include various investment options, catering to the evolving needs of its users.

As a Nigerian-owned company, PiggyVest is owned by Odunayo Eweniyi, a renowned Nigerian business executive and activist. The platform has garnered a strong reputation among Nigerians, offering a reliable and trusted investment platform.

3. Cowrywise

Cowrywise is a reputable investment platform in Nigeria that offers various savings and investment options to users. The platform provides both high-interest savings accounts and mutual funds, each with its own characteristics and potential returns. With high-interest savings accounts, Cowrywise guarantees returns, ensuring that users can grow their savings over time. However, the returns on mutual funds are subject to the performance of the chosen fund, which can result in both gains and losses.

Cowrywise is owned by Razaq Ahmed, CFA, who serves as the CEO and co-founder of the platform. His leadership and expertise contribute to the platform’s growth and success in the Nigerian investment landscape.

Founded in 2017 and headquartered in Lagos, Nigeria, Cowrywise has established itself as a reliable investment platform in the country. The company ensures the security of users’ funds by investing them in a mix of high-quality and low-risk financial instruments issued by the Central Bank of Nigeria and the Debt Management Office (DMO). The returns earned by users are derived from the performance of these investments.

As a testament to its legitimacy, Cowrywise has received an impressive approval rating of 4.5 stars from 1,771 users. Many reviewers have praised the platform, describing it as reliable, efficient, and amazing, showcasing the positive experiences of its users.

Withdrawals from locked Savings Plans on Cowrywise are only permitted on or after the maturity date chosen for a plan. This approach encourages committed savings and ensures effective investments of the saved funds, allowing users to earn interest on their savings if they choose to do so.

When comparing Cowrywise to PiggyVest, it’s important to note that both platforms offer savings and investment features, but they cater to different financial objectives. PiggyVest is primarily seen as a savings app, while Cowrywise provides a broader range of investment options. Therefore, Cowrywise may be better suited for individuals looking to explore investment opportunities beyond traditional savings.

One of the advantages of Cowrywise is its accessibility, as it allows users to start investing with as little as N1000 for Naira mutual funds and $10 for Dollar mutual funds. This low minimum investment amount makes it easier for individuals with varying budgets to participate in investment opportunities and grow their wealth.

4. Carbon

Carbon is a prominent investment platform in Nigeria that operates as a credit-led digital bank, catering to ambitious and tech-savvy Africans seeking control over their finances. Established in 2012, Carbon has evolved into a full-suite digital bank licensed and regulated by the Central Bank of Nigeria (CBN), ensuring its legitimacy and compliance with financial regulations.

As a digital bank, Carbon offers modern banking services, including loans, to its users. The company provides financial services through its mobile application, making it accessible and convenient for customers. Carbon’s loan offerings are highly regarded and approved by the CBN. New customers can qualify for loans ranging from ₦30,000 or ₦200,000, depending on meeting specific criteria, to higher loan amounts of ₦400,000 or ₦600,000.

The founders of Carbon, Chijioke Dozie and Ngozi Dozie, have successfully navigated the tech ecosystem and developed customer-centric models that set them apart in the industry. With their extensive experience and a decade-long presence in the Nigerian market, Carbon has established itself as a trusted and reliable investment platform for individuals looking for innovative financial solutions.

Overall, Carbon’s status as a licensed digital bank, its legitimate loan offerings approved by the CBN, and its visionary founders make it a noteworthy investment platform in Nigeria. By combining technology, accessibility, and a customer-centric approach, Carbon provides a valuable opportunity for users to manage their finances effectively and achieve their financial goals.

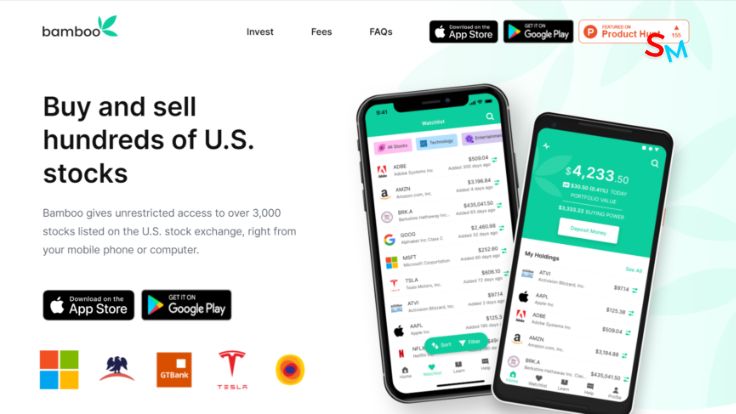

5. Bamboo

Bamboo is a legitimate and recognized investment platform in Nigeria that offers real investment opportunities. It is duly licensed by the Nigerian Securities Exchange Commission (SEC) as a digital sub-broker and is registered with the Corporate Affairs Commission of Nigeria. These credentials establish Bamboo’s authenticity and compliance with regulatory requirements.

Investors on Bamboo have the potential to earn up to 8% in dollar-denominated interest. By diversifying their investment portfolio and tapping into fixed returns investments, individuals can maximize their earning potential. The minimum deposit amount on Bamboo is $10, ensuring accessibility for a wide range of investors. Deposits reflect instantly in users’ Bamboo wallets, providing quick access to funds.

Although Bamboo faced a temporary challenge when the Central Bank of Nigeria (CBN) froze its bank accounts due to a misunderstanding, the situation has been fully resolved. Bamboo has cooperated with the CBN, providing all necessary information, and the case has been dismissed by the courts. This further reinforces Bamboo’s legal standing in Nigeria.

Bamboo requires user verification, and for Nigerian users, this is done through the Bank Verification Number (BVN) system. This verification process ensures compliance with regulatory standards and enhances the platform’s security.

Bamboo is owned by Richmond Bassey, who serves as the co-founder and CEO of the company. His leadership and expertise contribute to Bamboo’s growth and success in the investment industry.

Investors can transact in both Naira and foreign currencies on Bamboo, allowing flexibility and convenience. Users can make deposits into either their USD Wallet or Naira/Cedi Wallet, depending on their preferred currency.

6. RiseVest

Risevest is a reputable investment platform in Nigeria that was founded in 2019 by Bosun Olanrewaju, Eke Urum, and Tony Odiba. It offers Africans the opportunity to invest in foreign investment options, expanding their investment horizons. Risevest allows users to allocate their capital across a portfolio of US stocks, US real estate properties, and global fixed-income assets. While users have limited control over their choice of assets, they select the plan, and the company manages the investments on their behalf.

The legitimacy of Risevest as an investment platform is evident through its overall performance rating of 4 out of 5 stars. The platform enables users to choose their investment assets, and a team of financial experts handles the investment process. Risevest charges management fees on a percentage basis of the returns earned, ranging from 1.5% to 2% of the total investment and returns. However, if the returns are 10% or less, no charges are applied.

To earn on Risevest, users create a plan and invest their funds for a specific duration, such as 3, 6, or 12 months. The invested funds are parked in a portfolio of sovereign dollar-denominated bonds with maximum safety. At maturity, users receive both the principal amount and the earned interest.

The minimum amount required to invest in Risevest is as low as $10, making it accessible to a wide range of investors. The platform allows users to select their preferred investment duration and asset class, such as US stocks, US real estate, Eurobonds, or a combination of these options.

Risevest serves as a reliable investment platform in Nigeria, offering individuals the opportunity to diversify their investments globally.

7. Trove

Trove is a leading investment platform in Nigeria that provides individuals with the opportunity to trade global stocks and invest in a variety of financial assets. With Trove, users can easily buy publicly traded equities, bonds, and foreign assets using a debit card or bank transfer. The platform also allows for selling assets directly from the app, with the funds deposited into the user’s account.

Oluwatomi Solanke serves as the CEO of Trove, overseeing its operations and strategic direction. Trove is known as Nigeria’s pioneer stock trading and investment platform, offering users the convenience of trading global stocks from the comfort of their homes. Even with a minimum investment amount as low as $10 or ₦1,000, individuals can enter the world of investing and start building their portfolios.

Trove supports a wide range of investment options, including over 4,000 stocks, U.S. equities and exchange-traded funds (ETFs), American Depository Receipts (ADRs), as well as Nigerian stocks listed on the Nigerian Stock Exchange (NSE). Additionally, the platform provides access to mutual funds offered by top-tier mutual fund providers in Nigeria.

To begin investing on Trove, users need to deposit a minimum of $10 or ₦1,000 into their digital wallets. Once the funds are transferred, users can start exploring the available investment opportunities and make informed investment decisions.

With its user-friendly interface and diverse investment options, Trove empowers Nigerians to participate in the global financial markets and expand their investment portfolios. Whether trading stocks or investing in mutual funds, Trove provides a reliable platform for individuals to grow their wealth and achieve their financial goals.

8. Wealth NG

Wealth.ng is a prominent investment platform in Nigeria that offers individuals a wide range of investment opportunities. Titi Adeoye serves as the Managing Director and CEO of Wealth Ng, guiding the company towards its mission of empowering individuals to invest their money wisely.

Investing money with Wealth.ng is a straightforward process. The platform curates a diverse selection of investment options, including treasury bills, stocks, mutual funds, and real estate products. Users have the freedom to choose from this list and maintain full control over their investments. They can also make changes to their personal profile settings at any time, ensuring flexibility and customization according to their financial goals.

Wealth.ng is a product of WealthTech Limited, an affiliate of Sankore Securities Limited. Sankore Securities Limited, registered with the Nigerian Stock Exchange and regulated by the Securities and Exchange Commission of Nigeria, provides investment management and advisory services on the Wealth.ng platform. This ensures that users receive professional guidance from seasoned wealth management experts.

One of the benefits of using Wealth.ng is the access it provides to a diverse bouquet of investment products that are carefully selected to maximize returns. Additionally, users can leverage the expertise of personal wealth advisors who are available round the clock to provide customized wealth-building advice. Competitive returns on investments are another advantage offered by Wealth.ng.

When it comes to security, Wealth.ng prioritizes the safety of its users’ transactions and financial information. Payments on the platform are processed through Flutterwave, a PCI DSS certified payment platform that adheres to bank-level security standards, ensuring the utmost protection of sensitive data.

9. Payday Investor

PayDay Investor is an innovative investment app that offers individuals a convenient and secure way to grow their funds while working towards their investment goals. What sets PayDay Investor apart as a remarkable investment platform is its focus on capital preservation, ensuring that users never lose their invested money.

The legitimacy and safety of investing with PayDay Investor are assured by the fact that all funds deposited into the PayDay Investor Account are managed by ARM Investment Managers Limited. With over 25 years of experience in investment management and regulation by the Nigerian Securities and Exchange Commission, ARM Investment Managers Limited brings a wealth of expertise and credibility to the platform.

Using PayDay Investor is straightforward. Users can create investment goals and specify their desired time frame for achieving those goals. The app seamlessly connects to Nigerian debit cards, enabling users to automatically set aside funds periodically towards their investment goals. These funds are then invested in the ARM Money Market Fund, a trusted mutual fund that guarantees competitive interest rates, quarterly returns, and capital preservation.

PayDay Investor provides a reliable and user-friendly platform for individuals in Nigeria to earn interest on their investments while staying on track to achieve their financial objectives. With its emphasis on capital preservation, the app offers peace of mind and a secure environment for users to grow their funds over time.

10. Accrue

Accrue is an investment platform in Nigeria that allows users to automatically invest in high-performing stocks and cryptocurrencies, aiming for minimal risk and potential profits. Users can track stock prices, monitor their investment portfolio’s performance, and create wishlists to stay updated on preferred assets.

See also: 10 Instant Loan without BVN in Nigeria

The Risks of Investing in Nigeria

With all that happens in Nigeria nowadays, especially with government policies, we are forced to wonder If Nigeria is a good country to invest in. Investing in Nigeria can offer numerous opportunities, but it is important to be aware of the potential risks involved. Now, What is the risk involved in investing?

1. Economic and Political Risks

What are some challenges of investment in Nigeria? Nigeria’s economy is susceptible to various economic and political factors that can impact investments. Economic instability, inflation, government policies, and political unrest can all affect investment outcomes. Changes in regulations, taxation, and government policies can create uncertainties that impact business operations and investment returns.

2. Exchange Rate Risk

Nigeria operates a floating exchange rate system, which means that the value of the local currency (Naira) can fluctuate against foreign currencies. Exchange rate volatility can impact the profitability of investments denominated in foreign currencies and can pose challenges for repatriating funds.

3. Regulatory Risks

Investors in Nigeria should be mindful of regulatory risks. Changes in laws, regulations, or government policies can impact various sectors and specific investments. Compliance with regulatory requirements and obtaining necessary permits and licenses is crucial for businesses operating in Nigeria.

4. Fraud and Scam Risks

One of the factors affecting investments in Nigeria is fraud and scam risk, especially with the uprise of fraudsters or Yahoo boys. Nigeria has experienced instances of fraud and scams, including investment scams targeting unsuspecting individuals. Investors should exercise caution and conduct thorough due diligence before committing funds to any investment opportunity. Engaging with reputable financial institutions, registered investment firms, and conducting background checks on investment opportunities can help mitigate fraud and scam risks.

5. Market Volatility Risks

What is the risk involved in investing? The Nigerian financial markets can be subject to significant volatility due to various factors, including global economic conditions, political developments, and market sentiment. Fluctuations in stock prices, commodity prices, and interest rates can impact investment values. Investors should be prepared for market volatility and consider diversification strategies to manage risk.

How to Minimize the Risks of Investing in Nigeria

Risk-minimizing strategies involve conducting thorough research, diversifying investments, seeking professional advice, monitoring economic and political developments, and choosing reputable investment platforms to mitigate potential risks. Now, What are the five common ways to minimize business risk?

- Conduct thorough research: Gain a deep understanding of the Nigerian market, its sectors, and potential investment opportunities. Research economic indicators, political stability, and regulatory frameworks.

- Diversify your investments: Spread your investments across different asset classes and sectors to mitigate risks. Diversification can help offset losses in one area with gains in another.

- Seek professional advice: Consult with experienced investment professionals who have knowledge of the Nigerian market. They can provide valuable insights and guidance tailored to your investment goals.

- Monitor economic and political developments: Stay informed about economic trends, government policies, and political events that can impact investments. Regularly assess the macroeconomic environment for potential risks.

- Choose reputable investment platforms: Select established and regulated investment platforms with a track record of transparency and reliability. Research the platform’s reputation, security measures, and customer reviews before committing your funds.

With these five strategies to minimize risk, investors can minimize risks and make more informed decisions when investing in Nigeria.

How to Choose an Investment Platform in Nigeria

- Determine your investment goals

- Consider the platform’s reputation and track record

- Assess the platform’s features and services

- Evaluate the platform’s security measures

- Compare fees and charges

- Read user reviews and ratings

Other Things to Consider When Choosing an Investment Platform in Nigeria

- Investment options and asset classes

- Minimum investment requirements

- Ease of use and accessibility

- Customer support and service

- Transparency and reporting

- Additional features and tools

Conclusion

We have explored the topic of investment platforms in Nigeria and discussed important considerations when choosing the right platform. We have highlighted a selection of reputable investment platforms available in the country, offering a range of options for investors. It is essential to recognize the potential risks associated with investing and take appropriate measures to mitigate them, such as conducting thorough research, diversifying investments, seeking professional advice, and staying informed about economic and political developments. By carefully selecting an investment platform that aligns with individual preferences and goals, individuals can embark on their investment journey with confidence, knowing they have taken proactive steps to make well-informed decisions and pursue their financial aspirations. It is important to emphasize that successful investing requires thoughtful deliberation and a long-term perspective to achieve desired outcomes.

Leave a Reply