10 Instant Loan without BVN in Nigeria

Do you have urgent money problems that you must solve? Do you require a fast loan without BVN in Nigeria? It may seem unbelievable, but you can obtain immediate loans without giving your BVN. Essentially, certain financial platforms in Nigeria offer loans without the hassle of providing BVN or collateral. Here, you will discover everything you need to know about these platforms.

What is BVN and Why Has it Become so Important?

The Bank Verification Number (BVN) is a special 11-digit identification number assigned to every individual in the Nigerian Banking industry. The Central Bank of Nigeria introduced this biometric identification system to prevent and reduce unauthorized banking transactions in Nigeria. Its main purpose is to enhance security and reduce fraud in banking transactions.

It is crucial to keep your BVN number confidential and safeguarded at any cost. This is because certain fraudulent loan applications may attempt to misuse it for illegal purposes. Therefore, it is important to exercise caution when sharing your BVN on any platform.

See also: How to Check Nirsal Loan Status

The Best Instant Loan Available in Nigeria Even Without Your BVN

In Nigeria, there are numerous lending companies that offer quick loans to their customers. However, it is widely known that the leading loan apps in Nigeria typically ask users to provide their BVN as a requirement for loan approval. Is there any Nigerian loan app that doesn’t demand a BVN for granting loans?

On this page, you can find answers to all your queries about loans without a BVN. By the end of this post, you will have a better understanding of whether loan apps can block your BVN, whether your BVN remains secure when using loan apps, and where you can borrow money even if you don’t possess a BVN.

Top Instant Loan Without BVN In Nigeria

Here is a list of some of the top platforms where you can get loans without BVN in Nigeria:

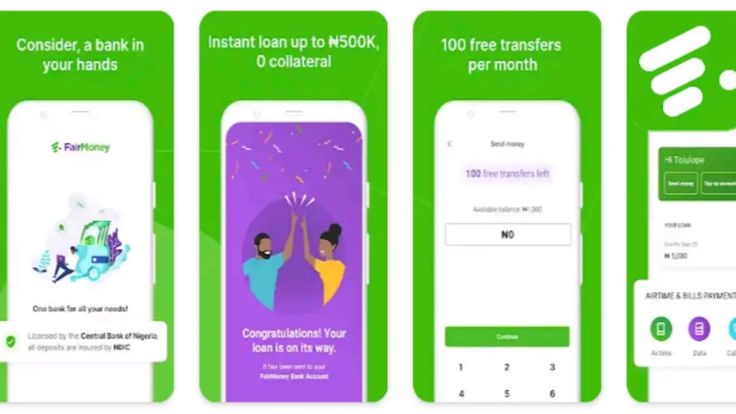

1. FairMoney Loan App

FairMoney loan platform provides you with instant cash to meet any of your financial needs, without requiring your BVN, documentation, collateral, or guarantor. Essentially, this app allows you to borrow amounts ranging from N1,000 to N150,000, with a repayment period of 2 to 12 weeks. The specific loan amount you can borrow depends on your creditworthiness.

Obtain a loan of up to N100,000 at the most affordable rates in Nigeria. Were you aware that you can now use our loan simulator to compare interest rates from different lenders and secure the best deal? Making an informed decision about a loan involves comparing various loan offers before committing. With our simulator, you can quickly see loan offers from different lenders in under 5 minutes, enabling you to make the right financing decision. Give it a try today.

2. JumiaOne Loan App

JumiaOne is a trustworthy loan app where you can borrow money without needing to enter your BVN. Essentially, to get a loan through this app, simply scroll down to the ‘Financial Services’ section and select ‘Loans’. Once you provide all the necessary information, you will receive your loan within minutes.

3. Carbon (Paylater) Loan App

Carbon, previously known as Paylater, is another reliable app that you can rely on. It is owned by the One Finance & Investment Limited company and provides more than just immediate loans. Apart from the convenience of obtaining loans ranging from N5000 to N1,000,000 with repayment terms of 7 to 180 days, the platform ensures prompt payment of your loan. Within just 3 minutes of submitting your application on the platform, they will transfer the loan amount to your account.

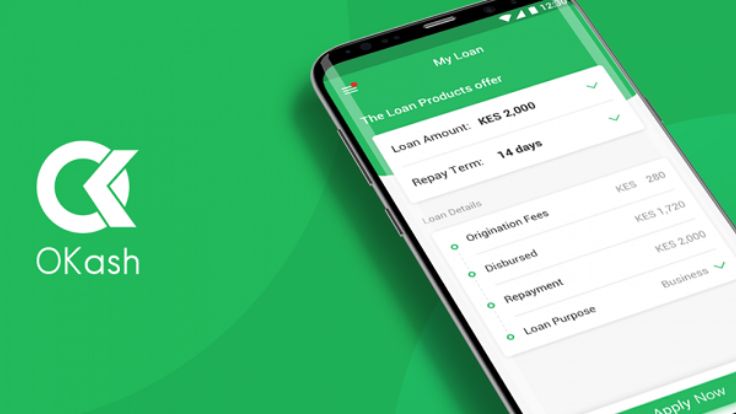

4. OKash Loan App

Okash loan app is another trustworthy and widely used platform for borrowing loans. Essentially, you can access this platform through the Opay mobile app, which is managed by Opay Digital Services Limited/Paycom. However, it’s important to note that OKash is exclusively owned and operated by Blue Ridge Microfinance Bank Ltd.

5. Aella Credit Loan App

Aella Credit is another trustworthy platform where you can borrow loans without providing your BVN. Essentially, this digital lending platform prioritizes the needs of its users and offers loans starting from as low as N2,000, with a maximum limit of up to N1,000,000. Moreover, their loan processing period is quick, taking only a short amount of time. Within just 10 minutes of applying for your loan, you will receive the credited amount.

6. Eyowo Loan App

You can rely on another instant loan app in times of urgent need without worrying about BVN. All you need is a verifiable phone number to be eligible for instant loans from the Eyowo loan app.

To access this, simply remove the first zero in your phone number and use the USSD code: *4255# on the Eyowo loan app. Alternatively, you can dial their IVR centre number at 10-7001511.

Their services are dependable and convenient. You can easily send and receive money without waiting in bank queues or dealing with the complexities of obtaining a loan from a traditional bank.

7. ALAT Loan App

The ALAT app is a fully digital bank that is owned and operated by the highly regarded WEMA Bank.

Take charge of your finances today by heading to your app store and downloading the ALAT app.

This app is supported by Wema Bank and enables you to conveniently send and receive money online. Additionally, you can enjoy the benefit of receiving a free customized ATM card for both Naira and Dollar (virtual) transactions.

With the Dollar ATM card, you can easily carry out online transactions. Having both virtual Dollar and Naira ATM cards allows you to access instant loans from the bank without the need for documents or collateral.

Feel free to borrow up to two hundred thousand Naira without requiring BVN, collateral, or documents. The bank provides a comfortable repayment plan and duration.

Furthermore, if you decide to save using the ALAT loan app, you can earn up to 10% of your savings.

8. CarrotPay App

CarrotPay is considered one of the top apps in the Fintech industry in Nigeria that swiftly approves loans without requiring your Bank Verification Number (BVN). With CarrotPay, obtaining a loan without entering your BVN is nearly as effortless as thinking about it. Once you pass the automated checks and have a favourable credit score, you can easily receive a loan within minutes of applying.

CarrotPay boasts a customer base of approximately 20,000 users and offers instant loans in Nigeria starting as low as N5,000 and going up to N50,000 in just a few minutes. The repayment period typically ranges from 2 to 3 months, with monthly instalments being the norm. The minimum interest rates are determined by a credit scoring algorithm, usually around 3% per month, while the maximum interest rate reaches up to 10%.

9. PalmCredit App

PalmCredit is a well-established and reliable lender in the digital industry that offers rapid loans without requiring borrowers to provide their BVN. The app provides loans ranging from N2000 to N100,000, with interest rates varying from 4% to 24%. The annual percentage rate (APR) falls between 24% to 56%. With over 5,000,000 users, PalmCredit has earned significant trust among its customers. The application is secure and follows ethical lending practices.

10. Quickteller App

Quickteller is a widely recognized and trustworthy lending app that grants instant online loans in Nigeria without requiring your BVN. Its loan processing is distinctive and enables swift cash disbursement once the loan is approved. With Quickteller, you can obtain immediate access to N10,000 for addressing any emergencies you may encounter, with an interest rate as low as 15%. To get started, simply register on their website by providing your name, email, password, and phone number.

See also: 9 New Loan Apps In Nigeria 2023

Comparison of Top Loan Apps Without BVN in Nigeria

To help you make an informed decision, we’ve compiled a tabular comparison of these platforms, spotlighting their key features, terms, and conditions.

From interest rates to user reviews, this comparison will make your choice a tad easier.

| Loan App | Interest Rate | Loan Amount |

|---|---|---|

| Carbon | 5% to 15% | Up to ₦20,000,000 |

| Fairmoney | 2.5% to 30% | Up to ₦500,000 |

| FlexiCash | 5% to 28% | Up to ₦50,000 |

| Aella Credit | 6% – 20% | Up to ₦1,000,000 |

| JumiaPay | 3.5% | Up to ₦100,000 |

| Okash | 3% to 30% | Up to ₦500,000 |

Can I get a loan without BVN in Nigeria?

It is extremely difficult to obtain a loan without a BVN in Nigeria. This is primarily due to the fact that financial institutions view individuals without BVNs as potential risks.

In February 2014, the Central Bank of Nigeria (CBN) and the Bankers’ Committee jointly launched the BVN project.

The main objective of this project was to collect the biometric data of all bank customers and assign them a unique identity that can be verified throughout the Nigerian banking industry.

The purpose of this unique verification system was to assist banks in their “Know Your Customer” (KYC) procedures.

Furthermore, the BVN project was also implemented to safeguard against identity theft and fraudulent banking transactions.

Benefits of enrolling for the BVN

As mandated by the CBN, all Nigerian bank customers are required to enrol for the BVN project.

Individuals with multiple accounts across different banks only need to enrol once.

Some of the advantages of having a BVN are:

● Unique identity

The BVN provides a distinct identity that can be verified throughout the Nigerian banking industry. This means that your BVN is not specific to just one bank.

● Account protection

The BVN safeguards customers’ bank accounts from unauthorized access. It has significantly reduced issues such as identity theft and the risk of fraud.

The BVN improves the banking industry’s ability to identify and take appropriate action against blacklisted customers.

● Identification method

Since the issuance of the National Identity Card has faced challenges in the country, the customers’ unique BVN is now widely accepted as a valid form of identification across all Nigerian banks and various government agencies.

To enrol for a BVN customers must present the following.

1. A BVN Enrolment form

2. A valid ID – International Passport, National ID card, Driver’s license or any other valid means of identification

3. One recent passport photograph

Why do lenders need your BVN?

Lenders in Nigeria require your BVN to verify your identity. This serves as a protective measure, allowing them to verify if you are indeed the person you claim to be.

This requirement became necessary due to the increasing number of loan defaulters at the time, many of whom had difficult-to-trace addresses.

While the BVN can assist in locating loan defaulters and potentially taking appropriate actions, it cannot be used to directly access or perform transactions on any bank account.

Its primary purpose is to provide information about the account owner and confirm personal details rather than serving as a means to deposit or withdraw funds from an account.

Why it isn’t easy to get loan without BVN

The BVN database is an effective and secure tool that loan apps utilize to verify customer identity and personal information. As a result, loan organizations in Nigeria mandate the submission of a BVN to prevent fraud and identity theft.

Moreover, the Money Laundering (Prohibition) Act 2011 holds banks accountable for the accounts they establish, enabling the detection of illegal activities like money laundering and identification of potential terrorist threats. This makes it unethical for loan apps in Nigeria to disburse loans without a BVN.

This stands as another reason why nearly all loan apps in Nigeria require a BVN for loan approval.

Your BVN may also indicate that you match the minimum eligibility criteria for a personal loan, such as being a

- Nigerian citizen, permanent resident, or holder of a long-term Nigerian visa (depending on lender requirements),

- and at least 18 years old.

Once your identification is established, certain Nigerian loan apps require proof of residence. If these apps are unaware of your place of residence, they are hesitant to provide you with funds.

Additionally, this process allows lenders to tailor your personal loan to align with the current state regulations.

Moreover, to safeguard against impersonation, reputable loan apps in Nigeria necessitate the use of a BVN for the identification process.

Obtaining a loan without a BVN is practically impossible since there is a significant likelihood that someone may request money in your name, leading to substantial future complications.

Without your knowledge, you may find yourself burdened with a debt you did not incur, resulting in default interest and potential inclusion of your name in delinquent records. All of this can occur without your awareness that someone has assumed your identity. This serves as another reason why loan apps or organizations cannot approve a loan without BVN.

See also: 7 Important Pros And Cons Of Taking Out A Personal Loan

Things to note about your BVN

As someone who holds a bank account, it is crucial to exercise caution with your BVN. If it ends up in the wrong hands, it can potentially provide unauthorized access to your bank account, allowing the withdrawal of all your funds.

Other things you need to note about your BVN include.

1. Loan access

Receiving a loan without BVN in Nigeria is nearly impossible. Loan organizations that don’t require a BVN will typically ask for guarantees or collateral in exchange for the loan.

Even when approving an unsecured loan, the borrower’s profile, income, and ability to repay are still taken into account. The lender needs to verify your borrowing capacity and repayment ability.

However, it’s worth noting that all loan organizations that provide loans without BVN are offline, and many of them resort to aggressive tactics to ensure repayment.

2. Loan apps can’t block your BVN

Loan apps in Nigeria do not have the ability to block your BVN. Only the CBN can impose restrictions on your BVN in Nigeria.

For example, if you fail to repay a loan, your information will be reported to the National Credit Bureau. This organization will classify you as a high-risk borrower, making it more challenging to obtain loans from any loan platform in the future.

Although having a negative rating with the Bureau might not seem significant right now, it can become a problem if you face a financial crisis and require credit. In such situations, no loan app in Nigeria would be willing to provide you with a loan due to your poor credit history.

To prevent this, it is crucial to continue repaying your loans, and if you are unable to do so, you can reach out to the loan app for assistance in negotiating a reduction in your debt.

● Your BVN is safe with loan apps

When you provide your BVN to loan platforms authorized by the National Information Technology Development Agency (NITDA), it is secure.

Since the BVN is linked to your financial records, if it falls into the hands of a fraudulent loan organization, they may gain access to all of your personal documents.

● Don’t share your BVN with anybody

It is not advisable to share your BVN with anyone, regardless of how close you may be to them.

Even if they have good intentions, there is a risk of them being careless and the BVN falling into the wrong hands.

You should only share your BVN when required by trusted financial institutions that are regulated by the government.

While fraudsters cannot directly steal money from your accounts with just the BVN, they may attempt to use your identity information to request your bank account details, ATM details, and ATM PIN.

Once they obtain this information, they can easily proceed to access and withdraw money from your bank accounts.

Can I get a loan without BVN in Nigeria?

Is it possible to obtain a loan in Nigeria without a BVN?

Only a small number of trustworthy loan apps in Nigeria provide loans without requiring your BVN.

Regrettably, the prevalence of fraudulent loan companies has increased alongside the growth of digital banking, which is why Nigerian loan apps emphasize identity verification.

The majority of legitimate loan apps in Nigeria will ask for your BVN as a prerequisite for processing your loan application.

Any loan platform that does not require your BVN should be carefully examined.

Why it is hard to get a loan without BVN

The BVN database provides a secure and reliable method for loan apps to verify the identity of their customers.

Nigerian loan companies require a BVN to prevent fraud and identity theft, and the Money Laundering (Prohibition) Act of 2011 holds banks accountable for the accounts they open.

Moreover, your BVN can also indicate that you meet the minimum eligibility criteria for a personal loan, such as being a citizen, permanent resident, or at least 18 years old.

Loan apps also require information about your residence to tailor your personal loan according to the regulations in your state. This may include being a Nigerian citizen, a permanent resident, or holding a long-term Nigerian visa, depending on the requirements set by the lender.

- To be eligible, you must be at least 18 years old.

- Once your identity is established, certain Nigerian loan applications require proof of your residential address. If they are unable to determine your place of residence, they cannot provide you with a loan.

- This is also how lenders customize your personal loan to comply with the laws in your state.

- Additionally, to prevent impersonation, all reputable loan apps in Nigeria require a BVN as part of the identification process.

- Obtaining a loan without a BVN is nearly impossible because someone could fraudulently request money in your name, leading to significant future troubles.

- If you are unaware that a loan has been taken out in your name, you may incur default interest on a debt you did not create, potentially resulting in your name being listed among debtors.

- All of this occurs without your knowledge that someone else has assumed your identity. This is another reason why loan apps or organizations cannot approve loans without a BVN.

How to spot fake loan apps in Nigeria

Fake loan apps pose a significant problem in Nigeria due to their aggressive methods of collecting loans. Their strategy involves offering loans in exchange for personal information and access to data on individuals’ phones, including contact lists, credit history, and financial standing.

1. Not listed on the Google Play Store

2. Harassment during loan collection

3. Facing penalties from financial authorities

4. Unsecured website

5. Poor customer reviews

6. Demands for upfront payments

7. Asking for passwords and sensitive data

8. Hidden loan terms and conditions

9. Attractive interest rates that seem too good to be true

Risks and Precautions When Using Loan Apps Without BVN

Even though borrowing money without BVN in Nigeria may seem convenient, it is important to be mindful of potential risks and difficulties. Always dedicate time to read and comprehend the terms and conditions of your loan agreement. Additionally, make sure that your personal information is handled securely and responsibly by the loan app.

Best Instant Loan Apps in Nigeria Without BVN – Complete List

In Nigeria, there are numerous loan apps available, and many of them typically ask for a Guarantor, Collateral, Verified Document, and BVN. However, here is a compilation of the top loan apps in Nigeria for 2023 that do not require BVN:

1. FairMoney Loan App

2. Okash Loan App

3. Carbon (Paylater) Loan App

4. PalmCredit Loan App

5. Quickteller App

6. Alat By Wema App

7. JumiaPay App

8. Aella Credit Loan App

9. Eyowo Loan App

10. CarrotPay App

FAQ

What is a loan app that doesn’t require BVN?

A loan app without BVN is a lending platform where borrowers can obtain loans without the need to provide their Bank Verification Number (BVN).

Can I get a loan without providing my BVN?

Yes, there are several financial platforms in Nigeria that offer loans without requiring your BVN or collateral. Some of these platforms include FairMoney, Aella Credit, JumiaOne, Carbon (formerly Paylater), and Okash.

Are loans without BVN safe?

Yes, loans without BVN can be safe as long as you use reputable and reliable lending platforms. However, it is important to exercise caution and only disclose your BVN on the intended platform.

Why do Nigerian loan companies require a BVN?

Nigerian loan companies require BVN to verify the identity of borrowers and mitigate the risk of fraudulent activities.

What is the best instant loan available in Nigeria without BVN?

There are several options available in Nigeria, including FairMoney, Aella Credit, JumiaOne, Carbon (formerly Paylater), and Okash. Each platform offers different loan amounts, interest rates, and repayment options. It is recommended to research and compare the options to find the best fit for your needs.

Do loan apps ask for BVN?

Yes, some loan apps may request BVN for identity verification when applying for a loan.

Where can I borrow money without providing my BVN?

You can borrow money without providing your BVN from loan apps/platforms such as Carbon, Okash, Palmpay, Jumiapay, Aella Credit, and FairMoney.

How can I get a loan without BVN verification in Nigeria?

To get a loan without BVN verification in Nigeria, you can apply through apps such as Carbon, Okash, Palmpay, Jumiapay, Aella Credit, and FairMoney.

Which loan app is fast?

It is subjective to determine which loan app is the fastest as it depends on various factors. However, we have listed some popular instant loan apps in Nigeria, including Okash, Aella Credit, FairMoney, Eyowo, and ALAT (Wema Bank) Credit.

Which loan app is the best?

There is no definitive answer to which loan app is the best. It ultimately depends on individual preferences and needs. It is advisable to compare the terms and conditions, including repayment plans, of various loan apps before making a decision.

How reliable are these loan apps?

The loan apps mentioned are considered legitimate and reliable. However, it is crucial to be cautious as there are fraudulent apps posing as reputable platforms. Exercise caution and use trusted sources when accessing loan apps.

Conclusion

There are multiple platforms in Nigeria where you can get loans without BVN. Just ensure that the app is genuine. You can select from the provided list to ensure your safety. Remember to keep your BVN private and be cautious about the platforms you share it with.

Leave a Reply